India's startup ecosystem, the world's third-largest, is a vibrant landscape teeming with unicorns and celebrated for its dynamism. Companies delivering groceries in minutes, streamlining digital payments, and offering online learning have become household names, transforming urban life and attracting significant investment. Yet, this success story, largely built on consumer-facing services, stands in stark contrast to the trajectory of China's technology sector. While India perfects delivery logistics, China is aggressively forging ahead in 'deep tech' – ventures rooted in fundamental scientific and engineering breakthroughs that tackle complex global challenges in fields like Artificial Intelligence (AI), Electric Vehicles (EVs), semiconductors, and biotechnology.

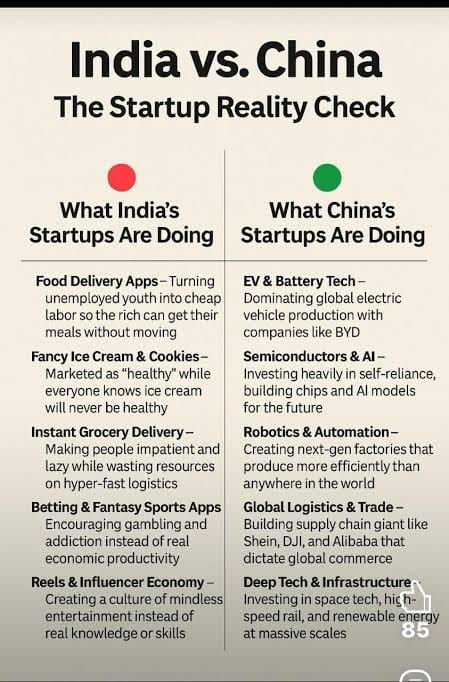

This divergence was thrust into the spotlight by pointed comments from India's Minister for Commerce and Industry, Piyush Goyal, at the Startup Mahakumbh event in early 2025. Presenting a slide titled "India Vs China: The Startup Reality Check," Goyal lamented India's perceived obsession with "food deliveries" and "fancy ice cream," questioning if the nation was content with "dukaandari (shopkeeping)" or aspired to global leadership through foundational innovation. His critique, asking if India was happy "being delivery boys and girls," ignited a fierce debate about the true value and direction of its celebrated startup ecosystem.

While Goyal's assessment of the ecosystem's output – a dominance of consumer convenience startups – is largely accurate, the reasons behind this are complex and systemic. Understanding why India trails China in the deep tech race requires examining the fundamental differences in their market structures, funding landscapes, R&D ecosystems, talent dynamics, and government strategies.

1. India's Consumer Tech Boom: Successes and Constraints

The Indian startup landscape is undeniably dominated by consumer-facing ventures. Food delivery giants like Zomato and Swiggy, quick commerce players like Zepto and Blinkit, e-commerce platforms like Flipkart, and a vast fintech ecosystem built upon India's world-class Digital Public Infrastructure (DPI) like UPI, capture the lion's share of attention and funding. In 2024, consumer tech attracted $5.4 billion, 2.3 times the previous year, and along with fintech and SaaS, accounted for nearly 60% of total funding in 2023.

These companies have created significant value: generating jobs, attracting FDI, contributing tax revenue, and vastly improving consumer convenience. However, this very success inadvertently steers the ecosystem away from deep tech's tougher path.

- Market Dynamics ("The Three Indias"): The structure of the Indian market, often described as "Three Indias," heavily influences business models.

- India-1: ~150 million affluent consumers driving ~66% of discretionary spending.

- India-2: ~300 million aspirational, value-conscious consumers.

- India-3: ~1 billion largely "unmonetizable" users with limited spending power. Successful startups often leverage India-1's capital and India-3's labor to serve India-2's consumption needs, prioritizing scale and service delivery over high-cost, high-risk deep tech products which might initially only appeal to niche segments of India-1 or industrial users.

- Nascent Deep Tech Scene: Despite the consumer focus, India does have a growing deep tech ecosystem, estimated at 3,600 to over 4,000 startups, ranking around 6th globally. Funding saw a significant jump to $1.6 billion in 2024, largely driven by AI (87% of the total). Areas like space tech (Skyroot), EVs (Ola Electric, Ather), defence tech, and biotech show promise. However, this $1.6 billion still represented only about 5% of total startup funding in 2023, highlighting the sector's under-resourcing compared to consumer tech and global peers. Significant hurdles like talent gaps, inadequate R&D labs, IP challenges, and the "Valley of Death" funding gap persist.

2. China's Deep Tech Powerhouse: A State-Orchestrated Ascent

China's leadership in deep tech is not accidental; it's the outcome of a deliberate, long-term, state-driven strategy aimed at technological self-reliance and global dominance in critical sectors.

- Strategic Sector Focus: National policies like "Made in China 2025" and successive Five-Year Plans explicitly prioritize AI, EVs and batteries, semiconductors, advanced robotics, biotechnology, and other frontier technologies. This has fostered global leaders like BYD (EVs), DJI (drones), SMIC (semiconductors), and numerous AI and robotics firms.

- Ecosystem Maturity: This strategic focus is backed by:

- Massive R&D Investment: China's R&D spending as a percentage of GDP is around 2.4% or higher, significantly outpacing India's ~0.64%. Crucially, Chinese businesses drive a much larger share of this R&D compared to India, where the government leads.

- Robust Infrastructure: Decades of manufacturing prowess provide mature supply chains, complemented by state-funded specialized infrastructure like national computing networks and dedicated industrial clusters.

- Large, Retained Talent Pool: China possesses a vast R&D workforce (estimated at 2.2 million in 2022 vs. India's 900,000) and is increasingly successful at retaining its top-tier AI and engineering talent.

- Scale Advantage: The enormous domestic market allows rapid scaling and cost reduction for deep tech innovations.

- State-Influenced Funding: Significant capital flows into deep tech via state-linked entities and government-backed funds, often prioritizing strategic alignment alongside financial returns.

While facing challenges like regulatory crackdowns and geopolitical tensions, China's combination of strategic direction, massive resources, and market scale creates a formidable deep tech innovation engine.

3. Analyzing the Divergence: Key Factors Driving the Gap

The distinct paths of India and China stem from fundamental differences across crucial ecosystem components:

- The Funding Gap: China attracts vastly more VC funding than India ($40.2B vs. $13.7B in 2024, though both saw declines). Critically, the allocation differs dramatically: an estimated 35% of Chinese VC went to deep tech in 2023, compared to only 5% in India. Even India's 2024 deep tech surge ($1.6B) was dwarfed by China's AI/semiconductor VC deals alone ($12.3B). China's state-backed funds actively direct capital strategically, while India relies more on market-driven VCs (often foreign, raising IP concerns) who, influenced by the "Three Indias" market, favor perceived faster returns in consumer tech. The lack of substantial domestic 'patient capital' in India is a major constraint for deep tech.

- R&D Ecosystem: India's low R&D intensity (~0.64% of GDP) compared to China's (~2.4%) is a major barrier. The reliance on public funding (59% in India vs. <30% in China, where businesses lead) indicates weaker private sector R&D engagement. India faces infrastructure gaps (labs, facilities), while China invests heavily in specialized R&D infrastructure. University-Industry Collaboration (UIC), vital for translating research, is also considered less mature and effective in India compared to China, hindered by funding, cultural barriers, and weaker IP commercialization pathways.

- The Talent Equation: While India has a large STEM graduate pool, challenges remain in quality, industry readiness, and specialization for deep tech fields. "Brain drain" sees top research talent migrating abroad seeking better opportunities, although retention is slowly improving. China boasts a larger R&D workforce and is increasingly successful at retaining its top-tier domestic talent, particularly in AI, creating a stronger human capital base for deep tech.

- Policy & Governance: China employs a top-down, heavily funded industrial strategy (e.g., "Made in China 2025") targeting specific deep tech sectors. India's approach ("Startup India") has been broader, though recent initiatives like PLI, India Semiconductor Mission (ISM), and IndiaAI Mission signal a move towards more targeting. However, the scale of funding and strategic focus often appears less forceful than China's. Furthermore, India is often criticized for bureaucratic hurdles ("red tape") and regulatory friction impacting implementation, despite potentially offering greater institutional transparency than China. India's unique strength is its DPI, offering potential deep tech applications yet to be fully leveraged beyond consumer tech.

4. Charting India's Path Forward: Building a Deep Tech Ecosystem

Minister Goyal's critique underscores a systemic challenge, not just a lack of ambition. The prevalence of convenience-focused startups is a rational response to India's current ecosystem conditions. Shifting this requires a concerted, multi-pronged strategy:

- Addressing Systemic Gaps:

- Funding: Drastically increase deep tech funding by encouraging domestic institutional investment (pension funds, insurers), expanding government funds (Fund of Funds), creating sector-specific strategic funds, and attracting foreign capital with streamlined regulations. Cultivate 'patient capital'.

- R&D: Significantly boost GERD, critically incentivizing private sector R&D (enhanced tax breaks, linking procurement). Build accessible, shared R&D infrastructure. Strengthen UIC through better frameworks for IP sharing and commercialization.

- Talent: Enhance STEM education quality and relevance. Implement targeted upskilling programs for deep tech roles. Create attractive domestic opportunities (funding, infrastructure, career paths) to retain top research talent. Leverage the diaspora.

- Policy: Ensure policy stability and predictability. Drastically reduce regulatory friction ("red tape") for deep tech and manufacturing startups. Strengthen IP protection and enforcement. Effectively implement the National Deep Tech Startup Policy (NDTSP).

- Leveraging Strengths: Actively explore deep tech applications for India's DPI. Target domestic market needs in areas like affordable healthcare, agritech, and sustainable solutions. Harness the large talent pool with focused training. Engage the Indian diaspora for expertise, investment, and market access.

- Evaluating Recent Initiatives:

- PLI Schemes: Successful in boosting manufacturing output and attracting investment in targeted sectors (including some deep tech areas like semis, batteries). However, their direct impact on fostering fundamental R&D and deep innovation, beyond assembly, needs scrutiny. Implementation challenges remain.

- IndiaAI Mission: A significant step with a ₹10,372 crore outlay, aiming to build compute infrastructure (10,000+ GPUs), support indigenous models, and fund startups. Potential is high, but success hinges on execution, affordable access to resources for startups, addressing data/talent gaps, and navigating complexities of sovereign AI development. The funding, while large for India, is modest globally.

These initiatives are positive but likely insufficient on their own. They must be part of a broader, deeper reform agenda.

Conclusion: The Imperative for Deep Tech Innovation

India stands at a crossroads. Its success in building a vibrant consumer startup ecosystem is undeniable, but the relative neglect of deep tech poses a significant risk to its long-term economic competitiveness, national security, and aspirations of becoming a developed nation ('Viksit Bharat'). The divergence from China is not merely about different startup choices but reflects deeply embedded systemic differences in markets, funding, R&D, talent, and policy.

Transforming India into a deep tech powerhouse requires a fundamental shift – moving beyond incremental improvements to embrace a national mission focused on foundational innovation. This necessitates massive, sustained R&D investment, fostering patient domestic capital, forging robust university-industry links, nurturing and retaining elite talent, and creating a truly enabling regulatory environment. It demands collaboration between government, industry, investors, and academia.

The challenge is immense, but the potential rewards – technological sovereignty, high-value job creation, solutions to pressing national and global problems, and a secure place among leading global economies – are transformative. The time for India to strategically invest in moving beyond "dukaandari" and building its future on the bedrock of deep technological strength is now.